The documents in our possession show how Jho Low and his team relied on a wide range of key professional advisors, mainly from the UK and the US, to pull off his deal with 1MDB.

These experts either knowingly engaged in his plan to make the PetroSaudi joint venture a “front” for further deals, or appear to have turned a blind eye to appropriate due diligence.

All of these businessmen, lawyers, bankers and politicians involved stood to make very large financial gains from their contributions to the 1MDB deal and some will face tough questions after the documents are handed in to the appropriate regulators next week.

Patrick Mahony – Investment Banker

This investment banker worked with the Ashmore Group, before joining PetroSaudi after the 1MDB deal as a director.

He had been involved in a previous joint venture between Ashmore and PetroSaudi, which had financed the oil company’s investments in Argentina in 2008 .

And when Tarek Obaid started negotiating with Jho Low he soon brought Mahony into the key negotiations.

After meeting Jho Low and his team for the first time Mahony wrote that he would “be happy” with the requirement that PetroSaudi should act “as a front” for Jho Low’s future deals.

It is clear that it was Mahony who masterminded the valuation of this relatively worthless oil company at a grossly inflated $2.9 billion dollars during the tense negotiations in the run up to the JV deal.

Emails show that in July Mahony had initiated an option on a so-called Farmin deal with a Canadian Company called Buried Hill, which held petroleum exploration rights in a politically contested region of Turkmenistan.

As of this time, these rights have yet to be exploited.

By September this option, which in the end cost PetroSaudi over USD$11 million to keep open, was due to expire.

Emails show that Mahony acted to extend the option for a further few weeks until the joint venture had been signed, but only after consulting with lawyers that such an extension would not bind PetroSaudi into taking up the agreement.

Mahony did not want to be “on the hook” of having to actually go through with taking up the option.

From: Patrick Mahony [mailto:[email protected]]

Sent: 01 September 2009 18:21

To: Paul Robinson

Subject: Re: BHE Extension LetterOk. Thanks.

Can we check one other thing under the psc with the turkmen govt. I presume a company must be in good standing, solvent etc or else the turkmen govt can terminate the psc. Can we please find out asap what the conditions are for the govt to terminate the psc?

Thanks

_____

From : Paul Robinson

Date : Tue, 1 Sep 2009 19:11:43 0200

To : Patrick Mahony <[email protected] >

Subject : RE: BHE Extension LetterIf this doesn’t get signed we need to terminate asap and by next Tuesday at the latest

Paul Robinson

Ashmore Investment Management Limited

_____

From: Patrick Mahony [mailto:[email protected]]

Sent: 01 September 2009 17:59

To: Paul Robinson

Subject: RE: BHE Extension LetterIt seems to me that that is what his email is implying. As long as we are sure, then i’m ok. I’ll get them to sign an extension. When do we need to terminate by?

From: Paul Robinson [mailto:[email protected]]

Sent: Tuesday, 01 September, 2009 6:21 PM

To: Patrick Mahony

Subject: RE: BHE Extension LetterWe’ve no obligation if the option is extended only once it expires – is Roger claiming otherwise?

thanks

Paul Robinson

Ashmore Investment Management Limited

_____

From: Patrick Mahony [mailto:[email protected]]

Sent: 01 September 2009 11:18

To: Paul Robinson

Subject: Re: BHE Extension LetterI had changed it to 120 days but apparently only in one place.

So this extends the option period, at which point we have no obligation. Once option period expires (and we don’t terminate farmin), then we are on the hook. Is that right?_____

From : Paul Robinson

Date : Tue, 1 Sep 2009 12:13:20 0200

To : Patrick Mahony <[email protected] >

Subject : RE: BHE Extension LetterNo – unless we fail to terminate the Farmin once the option period has expired – then it’s USD600k a month.

On Roger’s comments re: the extension letter – not sure I understand what he’s getting at. The letter’s attached again for reference. Is he going to sign this?

thanks

_____

From: Patrick Mahony [mailto:[email protected]]

Sent: 31 August 2009 22:17

To: Paul Robinson

Subject: FW: BHE Extension LetterAre we on the hook for anything under our current agreement…? Thanks

From: Roger Haines [mailto:[email protected]]

Sent: Monday, 31 August, 2009 6:03 PM

To: Tarek Obaid; Patrick Mahony

Cc: [email protected]; Hugh Leonard; Clayton Clift

Subject: Re: BHE Extension LetterHi Tarek, Patrick had raised the issue of 2 months and I had said 30 days was sufficient and that if we ran out of time we can always agree to extend. His letter appears to have both 120 days from signing (60 day extension) and 90 days fro signing (30 day extension). FYI, some very fast breaking news, it looks like the Environmental Impact Assessment that the government has pushed us to commence, could now start as early as the last week in September and that under our existing agreement the funds for this will have to be available as well. Estimated cost is about $ U.S. one million with a minimum payment of one third of the total up front. Roger

_____

From : Tarek Obaid <[email protected] >

To : Roger Haines; Patrick Mahony <[email protected] >

Cc : [email protected] <[email protected] >; Hugh Leonard; Clayton Clift

Sent : Mon Aug 31 08:11:56 2009

Subject : Re: BHE Extension LetterHi Roger,

If I remember correctly it was 60 days? Am I wrong?

TOn 31/08/2009 13:05, “Roger Haines “<[email protected] >wrote:

Hi Patrick, I am having Hugh and Joe look at it, I don’t think there is any problem with extending for a month but I believe there is a small timing glitch in the main agreement that will need to be addressed as well. The extension can be signed in counterpart or if you prefer it can be signed in London by either Hugh or Clayton. Roger_____

From : Patrick Mahony <[email protected] >

To : Roger Haines

Cc : Tarek Obaid <[email protected] >

Sent : Fri Aug 28 10:51:08 2009

Subject : Fw: BHE Extension LetterRoger – as discussed, attached please find an extension letter for our deal. As we are still in discussions and the period is going to expire early next week, we should try to get this signed early next week. Many thanks. Patrick

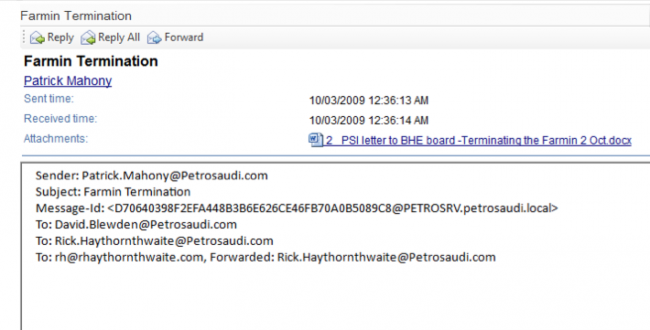

The day after the money from 1MDB was banked, October 3rd, Patrick Mahony informed his colleagues he was planning to terminate the option.

Subsequent negotiations for a possible merger with Buried Hill were then embarked upon, but these too were dropped before the end of the year in December 2009.

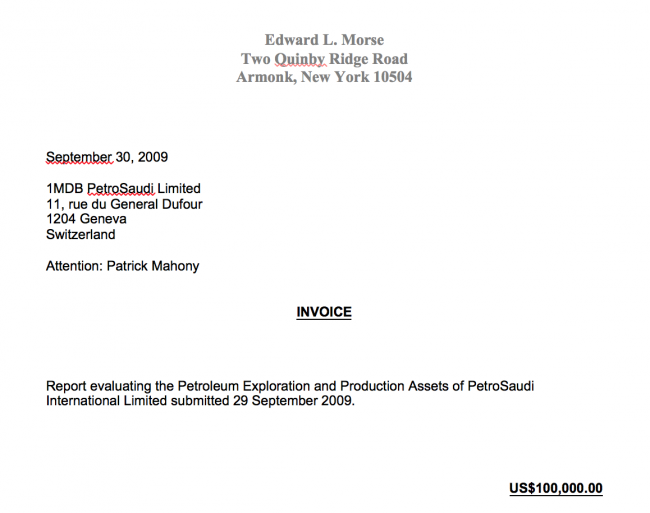

Ed Morse – Top US Banker/ Politician

Ed Morse is a senior American banker and a former Deputy Secretary of State for Energy.

He currently heads up the commodities desk at the giant US Citigroup bank, but in September 2009 he was between jobs following the collapse of Lehman Brothers, where he had previously worked.

Documents show that he was engaged by Mahony on behalf of the prospective joint venture group on September 20th, in order to value PetroSaudi on behalf of 1MDB.

As it was 1MDB’s own auditors who needed the reassurance on the asset value that PetroSaudi was allegedly bringing to the company, it might seem strange for them to have accepted a valuer who had been hired by their partner?

If so, even stranger was the fact that Morse was able to deliver his valuation of the company at a staggering USD$2.9 billion in less than ten days.

In his lengthy report Morse acknowledged that he had been heavily assisted in his preparations by information sent to him by PetroSaudi about their company.

This included, of course, the assumption that PSI was about to become a ‘Farm In’ partner of Buried Hill in their Turkmenistan concession on the Caspian Sea.

On the very day that Morse delivered his report on 29th September, 1MDB officials signed the JV Agreement.

It leaves certain questions about how hard and fast Shahrol Halmi and his fellow executives were able to read and digest this crucial but wordy valuation report, in order to check that it met their own due diligence requirements.

Because, by the end of the day they had validated it and signed all the necessary documents.

Morse, meanwhile, also on the same day of 29th September, issued an invoice for USD$100,000 for his week’s work, which appears to have been paid immediately.

RBS Coutts – Bankers to the Queen

RBS Coutts are the bankers to the Queen of England and their Chairman Earl David Hume is the son of a former British Prime Minister.

He is also the Chairman of the British Malaysian Society, amongst other august roles and appointments.

The documents available to Sarawak Report show that the private Swiss bank BIS had originally been approached to open an account for Good Star and discussed the proposed $700 million “premium” payment with Patrick Mahony.

However, it appears the deal did not sit well with their anti-money laundering compliance regulators, because the bank withdrew.

From: [email protected]

To: [email protected]

Subject: Additional information pleaseDear Patrick,

Please let us come back on our questions, my compliance needs some additional information before sending her presentation to our General Management.

_________________________________________________________________

1. Business Plan

Outflows

USD 100 JP Morgan London

USD 200 remains at 1MDB Petro Saudi Ltd (BVI)

USD 700 will go to various accounts to be opened at BSI (says Tarik Obaid) – to explainPM: The 100 (at JPM) and 200 (at BSI) will be used to fund the assets costs – basically exploration and production costs – and also to purchase assets. The 700m is premium that was made in the transaction and will be used to fund future transactions in any sector (not necessarily oil and gas)

We please need additional details on the remaining 700 m : beneficiaries, location, depositary bank ?

It seems that the Malaysian Sovereign Fund invests only in Malaysia. Is this money going back to Malaysia f.ex. and if so, when ?

_________________________________________________________________

2. Joint Venture Contract :

PM: The JV company is the BVI company called 1MDB PetroSaudi Ltd and this is a JV between PetroSaudi International (Holding) Cayman Ltd and 1 Malaysia Development Berhad (Malaysia) .

Our Compliance please needs the draft agreement between the contracting partners.

It is difficult for her to give an opinion to our General Management on the deal without the joint venture draft.

_________________________________________________________________

3. “1 Petro Saudi International Holdings Cayman Ltd (Cayman) ”

What is the purpose of this account and how will it be used please ?

__________________________ _________________________________________________________________

Thank you

Christophe Zuchuat

Directeur Adjoint

BSI SA

8, Boulevard du Théâtre – 1204 Genève

Tel. 41 58 809 13 52 – Fax 41 22 809 43 03

[email protected] – www.bsibank.com

________________________________________From: Patrick Mahony [mailto:[email protected]]

Sent: mercredi, 23. septembre 2009 23:21

To: Zuchuat Christophe (BSI-Geneve)

Subject: RE: Feedback compliance positive / GM also

Sensitivity: ConfidentialPlease see answers below. Let’s discuss tomorrow. Merci

From: [email protected] [mailto:[email protected]]

Sent: Wednesday, 23 September, 2009 5:33 PM

To: Patrick Mahony

Subject: Feedback compliance positive / GM also

Sensitivity: ConfidentialDear Patrick,

Thank you for your valuable information and help.

Our compliance is currently consolidating all information,

and will submit it to our General Management who is already informed.

Overall, the outlook is quite positive.Allow me 3 questions please :

____________________Business Plan

Outflows

USD 100 JP Morgan London

USD 200 remains at 1MDB Petro Saudi Ltd (BVI)

USD 700 will go to various accounts to be opened at BSI (says Tarik Obaid) – to explainCan you explain us briefly where and how the money will be invested ?

We suppose the business plan is financing oil investments/projects.

1. My compliance has to give some sort of explanation on the 700 especially .

We are very happy it stays at BSI.PM: The 100 (at JPM) and 200 (at BSI) will be used to fund the assets costs – basically exploration and production costs – and also to purchase assets. The 700m is premium that was made in the transaction and will be used to fund future transactions in any sector (not necessarily oil and gas)

_______________________

2. Joint Contract : it is not clear between which entities the contract will be :

Joint Venture Contract between : linked to cash flow ?

• 1Malaysia Development Bhd (Malaysia)

• 1MDB Petro Saudi Ltd (BVI)Joint Venture Contract between : linked to ownership ?

• 1 Petro Saudi International Holdings Cayman Ltd (Cayman)

• 1MDB Petro Saudi Ltd (BVI)PM: I don’t follow question, let’s discuss tomorrow. The JV company is the BVI company called 1MDB PetroSaudi Ltd and this is a JV between PetroSaudi International (Holding) Cayman Ltd and 1 Malaysia Development Berhad (Malaysia).

__________________________

PricewaterhouseCoopers

3. Valorization of Argentinean and Turkmenistan’s Assets : very important to get pleasePM: This will happen but may be another competent authority as PWC is being too slow.

__________________________

Thank you for your important support

Best regardsChristophe Zuchuat

Directeur AdjointBSI SA

8, Boulevard du Théâtre – 1204 Genève

Tel. 41 58 809 13 52 – Fax 41 22 809 43 03

[email protected] – www.bsibank.com

Last minute, post-signing amendments to the joint venture changed the details of the bank assigned to receive the money to RBS Coutts.

Yet emails, as late as 2nd October, indicate that RBS Coutts was also having problems, as its compliance team had yet to determine who was the beneficial owner of the account that was receiving the $700 million that had been paid by 1MDB.

Shahrol Halmi told his bank to inform Coutts that the beneficial owner was a company in the Seychelles called Good Star and it appears that by the end of the day the transfer had been completed.

So, are RBS Coutts in Zurich satisfied they performed their full due diligence duties in this transactions?

Rick Haythornewaite – Top Business Executive

This top British businessman is the Chairman of PetroSaudi deal and has held that position since before the joint venture deal.

He has also been Chairman of Master Card, Network Rail and currently he is the Chairman of Centrica (British Gas).

Haythornewaite is believed to receive a lucrative salary, in return for working two days a week at the PetroSaudi offices, which were originally a short step away from his residence near Victoria.

It is clear that he was not engaged in the direct correspondence surrounding the original 1MDB transaction.

However, he was closely involved in the merger talks with Buried Hill and he subsequently engaged extensively with investors, as PetroSaudi sought to expand its operations, following the injection of what eventually nearly totalled $1 billion in lending from 1MDB.

From: Rick Haythornthwaite [mailto:[email protected]]

Sent: 16 December 2009 14:17

To: jen…….od.com

Subject: Re: BHED

We have indeed broken off negotiations with BHE for good reason. Plenty to get on with though.

Let’s meet up in the New Year.

In the meantime, have a great Christmas.

With best regards

Rick Haythornthwaite

_____

From : <jenk….ood.com >

To : Rick Haythornthwaite <[email protected] >

Cc : David Allen <[email protected] >

Sent : Mon Dec 14 04:11:31 2009

Subject : BHERick

I’ve heard a rumour that the PSAE deal with Buried Hill has been called off. If correct that’s a shame given all the effort you’ve put in to make it work. And as we discussed when we met late October I did think it would have been a great “anchor asset “for PSAE, subject of course to resolving the boundary dispute between Azerbaijan and Turkmenistan.Anyway hopefully you have a Plan B for PSAE? In principle it remains a great vehicle for the upstream hydrocarbon sector.

I’m in the UK for the next couple of months if you thought there was merit in a further chat.

Regards

Records seen by Sarawak Report show that after the $300 million injected in the initial transaction there were at least two more tranches of lending by 1MDB into PetroSaudi of $340 million in July 2010 and another $340 million in September 2010.

Tony Blair – International Politician

The benefits of getting Tony Blair in as a paid ‘Ambassador’ for PetroSaudi were obvious for previously this little known company trying to create a front as a major player.

Blair himself is the current Middle East Envoy for the US, EU, UN and Russia, but his private business activities run parallel to his continuing political activities, raising widespread criticism in the UK.

Earlier revelations by the Sunday Times showed that PetroSaudi had hired him on a contract for $65,000 a month and a 2% cut on any oil deal that he had a hand in negotiating.