Another bombshell has been detonated by international investigators under the Prime Minister of Malaysia’s rickety construction of lies over 1MDB.

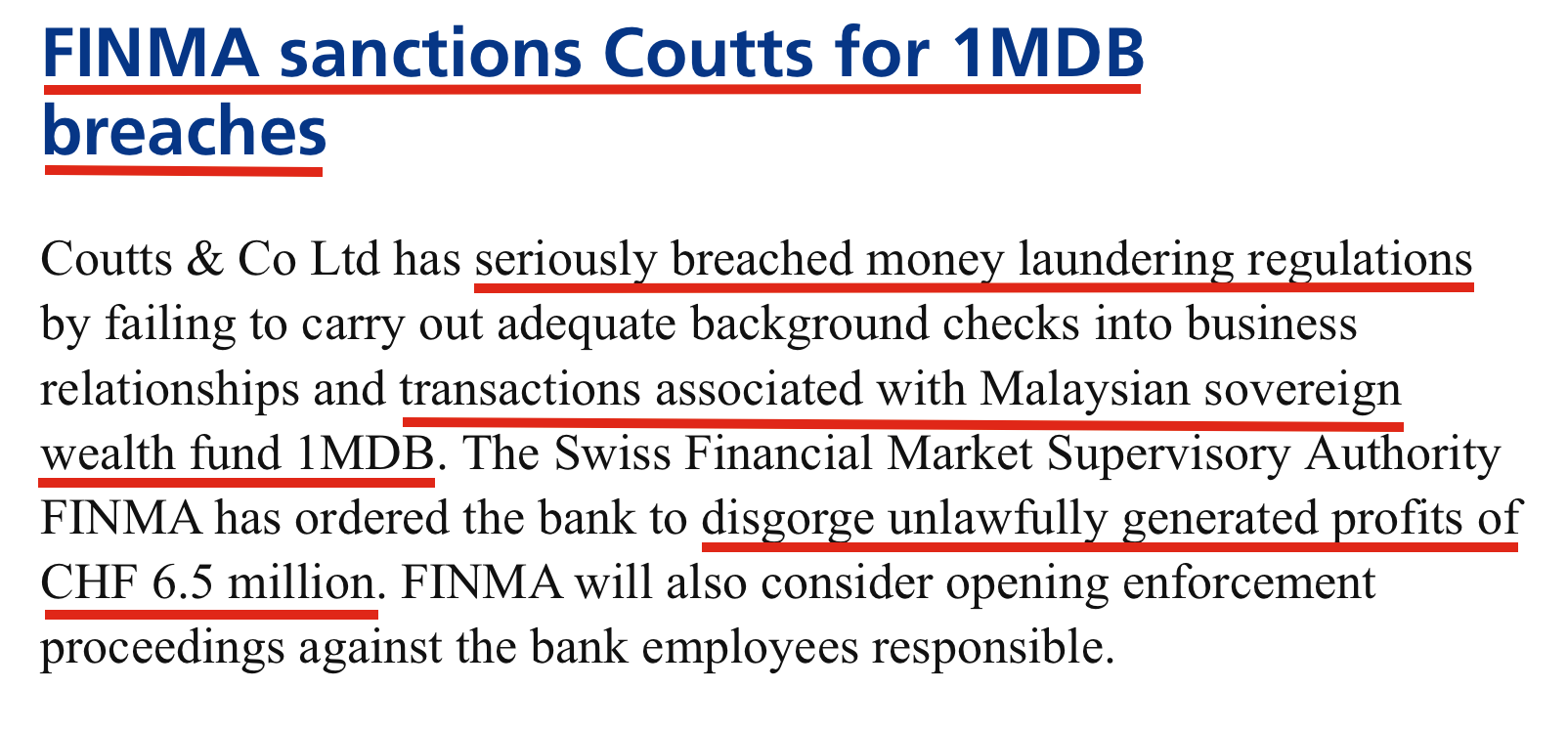

Today the Swiss finacial regulator, FINMA, finally produced its devastating verdict on the conduct of the private bank Coutts, which was exposed by this news site as the major facilitator of the original 1MDB heist back in February 2015.

Having closed down investigations in Malaysia, which had turned up volumes of information resulting in a series of charges being drawn up against the Prime Minister, Najib’s new Attorney General has dogedly maintained that there was no evidence of wrong-doing or misappropriation at the fund.

Yet today, FINMA detailed a trail of theft from 1MDB in a statement that further corroborates findings by the United States Department of Justice and the Singapore Courts. The authority has therefore sanctioned the bank for having facilitated the heist and failing catastrophically in its anti-money laundering requirements.

As part of the punishment the Swiss financial authority has commanded Coutts, which was owned by the UK state-owned bank RBS at the time of the transgressions, to disgorge a stunning US$ 6.5 million (CHF 6.5 m) in illegal profits from its 1MDB relationship.

Possible criminal charges are also pending against individuals at the bank.

Detailed Charges

The FINMA statement, the product of over a year of investigation, lays out in detail what took place between Coutts and 1MDB, referring plainly to the fund’s criminal collaborators, who were Najib’s advisor Jho Low and the directors of the company PetroSaudi.

This detailed information contrasts with the vague and contradictory denials from 1MDB and Najib Razak over past months, which have failed to provide any other convincing explanation for the disappearance of billions from the fund, whilst claiming that an anonymous Saudi Royal donated the billions that subsequently popped up in Najib’s own KL bank account.

The Department of Justice has in fact traced the bulk of that money directly back to 1MDB.

Key relationship started early

According to FINMA the relationship between certain Coutts bank employees in Singapore and ‘individuals who subsequently became associated with 1MDB” started back in 2003.

Coutts was involved at an early stage

In 2003, some employees of the Singapore branch of Coutts entered into business relationships with individuals associated with what became known as the sovereign wealth fund 1MDB. Coutts, through its branch in Singapore, was the first Swiss bank to accept assets from these individuals. [FINMA Statement]

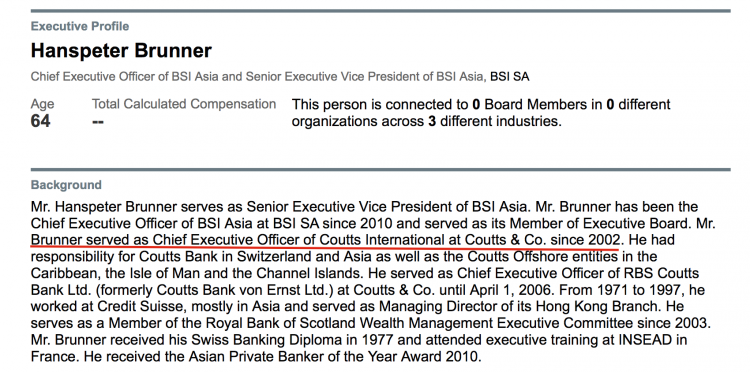

There is little doubt that the regulator is referring to Jho Low and his relationship manager Yak Yew Chee (currently serving time having pleaded guilty to a number of related charges in Singapore) and at a later stage Yak’s boss, HansPeter Brunner, who took charge of the branch in 2002.

Sarawak Report was the first to reveal that it was Jho Low who had incorporated an off-shore company May 18th 2009, named Good Star Limited, in the Seychelles with the assistance of the team at Coutts Singapore, which was registered as the principal client on the account.

Coutts agreed to the last minute cash transfer

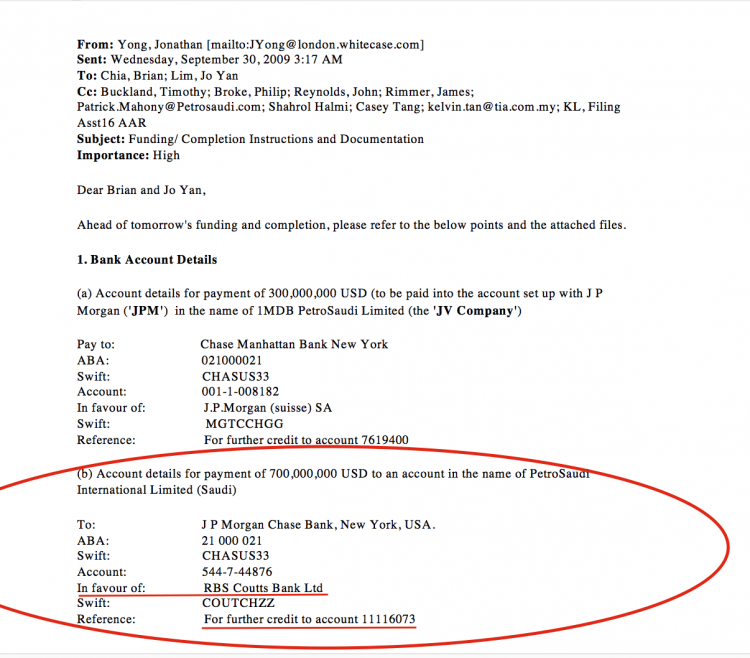

Separately, we have published email evidence from PetroSaudi’s data, which shows that initially Low had hoped to set up an account at BSI Bank in Geneva in late September 2009, in order to receive $700 million (originally $720 million) siphoned out from 1MDB in the guise of a bogus loan repayment to PetroSaudi as part of the joint venture contract.

PetroSaudi had also planned to place its joint venture business account at BSI and emails make clear that the collaborators believed that having both accounts at the same bank would help in promoting the fiction that PetroSaudi owned Good Star.

This was laid out in an internal document named ‘PetroSaudi Plan’ – sent to PetroSaudi directors by Low assistant Seet Li Lin 15/09/09, showing how the $700 million would be diverted to Low in his capacity as “Promoter” of the deal.

Objectives to be met:

- Signing by 30th Sept 2009

- First tranche of Malaysian investments: US$1,000mm

- US$280mm will remain in JV company

- US$720mm will be moved via PSI

- MDB must hold 49% or less in JV company

- MDB to recognize approximately US$186mm in revaluation gains due to buying below valuation due to ability to close the deal fast.

Issue Structure:

- Is it possible to use a BVI for the new JV company instead of Cayman Island company?

- We will like to structure the US$720mm as a repayment to PSI for loans extended to the JV company or asset.

PATRICK: please improve on our proposed structure as you deem fit.

Issue: Valuer

- Timeline consideration. Time required to generate report.

- Valuation figure. We need to work backwards, with the objectives above in mind to produce the right valuation.

Issue: Agreements required

- For MDB – Joint venture agreement with PSI

- 5 board members including 1 chairman

- Chairman will be PSI

- MDB will nominate 2 members, PSI will nominate 3 members

Issue: Official story

- MDB is partnering the Saudi royal family to spur sustainable economic development in Malaysia by investing in global renewable and non-renewable energy resources and others.

Issue: Bank Accounts

- BSI as bankers

- Company receiving the monies must use same bank as Promoter

- Payment out of PSI must follow immediately after its receipt at PSI

Meeting in Switzerland

- Meeting BSI

- Preparation of various agreements to pay Promoter – $720mm

- 1 introduction fees to Promoter

- Several deep in the money derivative contracts in favor of Promoter (with various companies)

Preparation Work

- Appointment of lawyers by us.

Clarifications:

- PSI will appoint its own lawyers.

Potential Structure

- PSI create new BVI company as new joint venture vehicle (PSI-1MDB Future Energy Corporation)

- PSI sells Argentina asset to PSI-1MDB Future Energy Corporation for US$50mm. This will be funded in shares.

- PSI sells Turkmenistan asset to PSI-1MDB Future Energy Corporation for US$1720mm. This will be funded by US$1000mm in shares and US$720mm in advances.

- 1MDB pays US$1000mm. US$720mm used to clear advances. US$290mm remains in PSI-1MDB Future Energy Corporation. 1MDB should own 48.8% of PSI-1MDB Future Energy Corporation, PSI should own 51.2% of PSI-1MDB Future Energy Corporation.

- Valuation report should come in to value assets at US$3.285bn. This will result in US$186m gains attributable to the US$1000m investment made by 1MDB.

Key Dates:

18th Sept (Fri) – Meeting in Geneva

30th Sept (Wed) – Prince Turki in Malaysia for official signing

However, compliance officers at BSI pulled out of the deal just two days before the signing of the 1MDB PetroSaudi Joint Venture, after asking increasing questions about compliance, leaving the collaborators with a problem.

From: [email protected]

To: [email protected]

Subject: Additional information please

Dear Patrick,

Please let us come back on our questions, my compliance needs some additional information before sending her presentation to our General Management.

_________________________________________________________________

1. Business Plan

Outflows

USD 100 JP Morgan London

USD 200 remains at 1MDB Petro Saudi Ltd (BVI)

USD 700 will go to various accounts to be opened at BSI (says Tarik Obaid) – to explain

PM: The 100 (at JPM) and 200 (at BSI) will be used to fund the assets costs – basically exploration and production costs – and also to purchase assets. The 700m is premium that was made in the transaction and will be used to fund future transactions in any sector (not necessarily oil and gas)

We please need additional details on the remaining 700 m : beneficiaries, location, depositary bank ?

It seems that the Malaysian Sovereign Fund invests only in Malaysia. Is this money going back to Malaysia f.ex. and if so, when ?

_________________________________________________________________

2. Joint Venture Contract :

PM: The JV company is the BVI company called 1MDB PetroSaudi Ltd and this is a JV between PetroSaudi International (Holding) Cayman Ltd and 1 Malaysia Development Berhad (Malaysia) .

Our Compliance please needs the draft agreement between the contracting partners.

It is difficult for her to give an opinion to our General Management on the deal without the joint venture draft.

_________________________________________________________________

3. “1 Petro Saudi International Holdings Cayman Ltd (Cayman) ”

What is the purpose of this account and how will it be used please ?

__________________________ _________________________________________________________________

Thank you

Christophe Zuchuat

Directeur Adjoint

BSI SA

8, Boulevard du Théâtre – 1204 Genève

Tel. 41 58 809 13 52 – Fax 41 22 809 43 03

[email protected] – www.bsibank.com

________________________________________

From: Patrick Mahony [mailto:[email protected]]

Sent: mercredi, 23. septembre 2009 23:21

To: Zuchuat Christophe (BSI-Geneve)

Subject: RE: Feedback compliance positive / GM also

Sensitivity: Confidential

Please see answers below. Let’s discuss tomorrow. Merci

From: [email protected] [mailto:[email protected]]

Sent: Wednesday, 23 September, 2009 5:33 PM

To: Patrick Mahony

Subject: Feedback compliance positive / GM also

Sensitivity: Confidential

Dear Patrick,

Thank you for your valuable information and help.

Our compliance is currently consolidating all information,

and will submit it to our General Management who is already informed.

Overall, the outlook is quite positive.

Allow me 3 questions please :

____________________

Business Plan

Outflows

USD 100 JP Morgan London

USD 200 remains at 1MDB Petro Saudi Ltd (BVI)

USD 700 will go to various accounts to be opened at BSI (says Tarik Obaid) – to explain

Can you explain us briefly where and how the money will be invested ?

We suppose the business plan is financing oil investments/projects.

1. My compliance has to give some sort of explanation on the 700 especially .

We are very happy it stays at BSI.

PM: The 100 (at JPM) and 200 (at BSI) will be used to fund the assets costs – basically exploration and production costs – and also to purchase assets. The 700m is premium that was made in the transaction and will be used to fund future transactions in any sector (not necessarily oil and gas)

_______________________

2. Joint Contract : it is not clear between which entities the contract will be :

Joint Venture Contract between : linked to cash flow ?

• 1Malaysia Development Bhd (Malaysia)

• 1MDB Petro Saudi Ltd (BVI)

Joint Venture Contract between : linked to ownership ?

• 1 Petro Saudi International Holdings Cayman Ltd (Cayman)

• 1MDB Petro Saudi Ltd (BVI)

PM: I don’t follow question, let’s discuss tomorrow. The JV company is the BVI company called 1MDB PetroSaudi Ltd and this is a JV between PetroSaudi International (Holding) Cayman Ltd and 1 Malaysia Development Berhad (Malaysia).

__________________________

PricewaterhouseCoopers

3. Valorization of Argentinean and Turkmenistan’s Assets : very important to get please

PM: This will happen but may be another competent authority as PWC is being too slow.

__________________________

Thank you for your important support

Best regards

Christophe Zuchuat

Directeur Adjoint

BSI SA

8, Boulevard du Théâtre – 1204 Genève

Tel. 41 58 809 13 52 – Fax 41 22 809 43 03

[email protected] – www.bsibank.com

With the clock ticking, PetroSaudi turned to JP Morgan, where Director Tarek Obaid had business and that bank agreed to accept the account for the joint venture, which was to receive $300 million out of the $1 billion transferred from 1MDB.

Jho Low, who was now looking for a place to park the remaining $700 million “loan repayment to PetroSaudi”, turned to his own existing relationship, which was at Coutts.

Frantic emails were exchanged in the closing hours of the joint venture deal between 1MDB, PetroSaudi and Coutts compliance officers in Zurich over this sudden request to transfer $700 million into a newly created account, which showed the concern amongst Coutts staff about accepting this huge and suspicious sum of money when there was inadequate information about who owned the account and how the money had been earned.

Sent via BlackBerry from T-Mobile

From : [email protected]

Date : Fri, 2 Oct 2009 12:28:01 0000

To : <[email protected] >

Subject : Fw: RESEND : URGENT REQUEST OF RBS COUTTS

Shld be cleared soon. Pls update tarek.

Sent via BlackBerry from T-Mobile

_____

From : Shahrol Halmi

Date : Fri, 2 Oct 2009 08:21:15 -0400

To : ‘[email protected]’ <[email protected] >; Casey Tang <[email protected] >

Subject : Re: RESEND : URGENT REQUEST OF RBS COUTTS

Jac, please use this address for GOOD STAR LIMITED.

P.O.Box 1239, Offshore Incorporation Centre, Victoria, Mahe, Republic of Seychelles

Thanks

_____

From : Jacqueline Ho <[email protected] >

To : Casey Tang; Shahrol Halmi

Sent : Fri Oct 02 06:19:20 2009

Subject : RESEND : URGENT REQUEST OF RBS COUTTS

Dear Casey and Shahrol

Please see an email request from RBS Coutts to reveal the beneficiary name pertaining to 1MDB’s remittance.

In that sense, I believe RBS needs confirmation on the beneficiary’s name in order to complete their internal risk mitigating processes as no name was

We will await your instructions on whether to reveal the beneficiary name and address (please provide) to RBS Coutts.

As requested by them, we will have to send it out via email and an authenticated swift message so would appreciate a reply as soon as possible.

Best Rgds

Jacqueline Ho

Corporate Coverage

Deutsche Bank (M) Bhd

Tel: 603 20317798

Mob: 6012 2059561

Email: [email protected]

—

This e-mail may contain confidential and/or privileged information. If you

are not the intended recipient (or have received this e-mail in error)

please notify the sender immediately and destroy this e-mail. Any

unauthorized copying, disclosure or distribution of the material in this

e-mail is strictly forbidden. —– Forwarded by Jacqueline Ho/db/dbcom on 10/02/2009 05:41 PM —–

Prakash Gopi/db/dbcom

10/02/2009 04:55 PM

To Jacqueline Ho/db/dbcom@DBAPAC

cc Jeremy Lewis/db/dbcom@DBAPAC

Subject Fw: REQUEST OF COUTCHZZ

Jac,

RBS Coutts is requesting for bene’s full details.

Can we proceed to provide the necessary information. If so, appreciate if you could provide me with the relevant details.

Warm Regards,

Prakash Gopi

Global Market Operations

Deutsche Bank (M) Bhd

03-20536851

—– Forwarded by Prakash Gopi/db/dbcom on 02/10/2009 04:53 PM —–

02/10/2009 04:38 PM

To Prakash Gopi/db/dbcom@DBAPAC

cc [email protected], [email protected]

Subject RE: REQUEST OF COUTCHZZ

Dear Prakash,

Please urgently confirm the full name of the final beneficiary of the funds per e-mail and authenticated swift (see details below) in order for us to apply the funds.

We are not in a position to credit the funds without full beneficiary details (full name, address, account no.).

Kind regards,

Mr Laurent Schmid

Regulatory Risk

RBS Coutts Bank Ltd

Lerchenstrasse 18

P.O. Box

8022 Zurich, Switzerland

Tel. 41 43 245 53 52

Fax 41 43 245 54 04

[email protected]

www.rbscoutts.com

____

From: Humair, Eliane (RBS Coutts, CH)

Sent: Freitag, 2. Oktober 2009 10:27

To: Cousin, Dominik (RBS Coutts, CH); Tuerler, Thomas (RBS Coutts, CH); Schmid, Laurent (RBS Coutts, CH)

Subject: FW: REQUEST OF COUTCHZZ

TO URGENT

Eliane Humair

Investigations Department

RBS Coutts Bank Ltd

Stauffacherstrasse 1

P.O. Box

8022 Zürich

Telephone 41 (0)43 245 58 62

Facsimile 41 (0)43 245 57 99

[email protected]

www.rbscoutts.com

_____

From: Prakash Gopi [ mailto:[email protected]]

Sent: Freitag, 2. Oktober 2009 10:22

To: Humair, Eliane (RBS Coutts, CH)

Cc: Jeremy Lewis; Krystof Balwierz

Subject: Fw: REQUEST OF COUTCHZZ

Dear Eliane,

I have received this msg from Krystof Balwierz on behalf of yourself today.

May i urgently enquire what further details you require from DEUTMYKL since our MT103 msg had indicated that the funds were to be credited to acc 11116073.

Thank you.

Warm Regards,

Prakash Gopi

Global Market Operations

Deutsche Bank (M) Bhd

03-20536851

—– Forwarded by Prakash Gopi/db/dbcom on 02/10/2009 04:13 PM —–

Chooi-Fong Liew/db/dbcom

02/10/2009 04:09 PM

To Krystof Balwierz/db/dbcom@DBCOM cc

Prakash Gopi/db/dbcom@DBAPAC Subject

Fw: REQUEST OF COUTCHZZ

Hi Krystof

I have forwarded the email to my colleague who is handling this. You can laise directly with him direclty.

Regards.

Chooi fong

—– Forwarded by Chooi-Fong Liew/db/dbcom on 10/02/2009 04:06 PM —–

Chooi-Fong Liew/db/dbcom

10/02/2009 04:01 PM

To Prakash Gopi/db/dbcom@DBAPAC cc

Subject

Fw: REQUEST OF COUTCHZZ

Pls help.

—– Forwarded by Chooi-Fong Liew/db/dbcom on 10/02/2009 04:01 PM —–

Chooi-Fong Liew/db/dbcom

10/02/2009 03:59 PM

To Connie Lam/db/dbcom@DBAPAC, Umadevi Maslamani/db/dbcom@DBAPAC cc

Subject Fw: REQUEST OF COUTCHZZ

HI

Pls note email below . Did you send the pymt instruction? Bene Bank unable to apply. Pls provide addl details via BKTRUS33.

Thanks.

Chooi fong

What can be seen is that Jho Low was himself being back-copied into these emails (above) and that he responded to his colleagues at PetroSaudi (also back-copied) that the problem would soon be resolved.

FINMA’s further evidence today makes clear that individuals high up at the bank over-ruled the concerns of the compliance department and that there were numerous shortfalls in the due diligence process and in the documentation provided by Jho Low:

“In the summer of 2009, Coutts opened a business relationship in Zurich with a young Malaysian businessman. When the account was opened, information was provided to the effect that USD 10 million would be transferred to it from the account holder’s family assets. Instead, in the autumn of 2009, approximately USD 700 million was transferred to the account from the Malaysian sovereign wealth fund 1MDB. The reasons given for this transaction were inconsistent, and some information was changed retrospectively. Moreover, the documents presented in support of the transaction contained obvious mistakes, not least the fact that the identities of the contracting parties were transposed. A member of the bank’s Compliance unit noted in an internal email: “It would be the first time in my career that I would see a case where [in] an agreement over the amount of USD 600 Mio. or so the role of the parties has been confused.” The Legal Services unit even spoke of the risk of a “total fabrication”. Nevertheless, the bank failed to clarify the background to the transaction with the necessary diligenc [FINMA Statement]

It is noticeable that within this last minute rush and change of plans there were still attempts made to disguise the eventual destination of the money from people who might be scrutinising matters in Malaysia.

Both payments were initially sent to JP Morgan, in order to create an appearance that the money had all gone to PetroSaudi, however the $700 million payment was then designated for forwarding to the separate Coutts account:

The FINMA statement is unequivocal in support of the finding that $700 million was therefore stolen from 1MDB in September 2009 under the guise of the joint venture with PetroSaudi and went to Jho Low. Something the Prime Minister has repeatedly denied.

The authority effectively also corroborates Singapore’s findings that Jho Low later sent much of the money (over half a billion dollars) on to his ADKMIC account at BSI Bank in Singapore, where Brunner, Yak and their team moved over to in October of that year:

“Subsequently, between late 2009 and early 2013 numerous high-risk transactions with a total value of USD 1.7 billion were processed through the account. For example, more than USD 0.5 billion was transferred to a domiciliary company belonging to the businessman on the basis of intransparent loan agreements. The bank justified these actions on the basis that the same beneficial owner was involved. Coutts took no action to clarify the use of USD 35 million for visits to casinos and the purchase of a range of luxury services (e.g. the chartering of yachts and private aeroplanes).”

Even more money went through Coutts in later 1MDB transactions

Altogether, FINMA has confirmed that as much as $2.4 billion went in total through from 1MDB through Jho Low’s accounts at Coutts Zurich, far more than the $1.83 billion that disappeared from the original PetroSaudi joint venture with 1MDB through Good Star:

“When the Coutts employees moved to another bank in Singapore in 2009, some of the business relationships were transferred to Coutts Zurich. In total, 1MDB-related assets to the value of USD 2.4 billion were transferred through Coutts accounts in Switzerland” [FINMA Statement]

This supports the DOJ’s earlier contention that money raised from later 1MDB borrowing associated with the Aabar Abu Dhabi wealth fund (whose managers have now been jailed for their part in the 1MDB scandal) also went through Coutts.

US$6.5 billion was raised in loans 2012-13 by Goldman Sachs (whose Asia head is now sacked and under investigation in the United States), much of which has been traced to bogus off-shore accounts through BSI and Falcon Bank set up by Jho Low (alias Eric Tan) and the ex-managers of Aabar (Khadem Al Qubaisi and Mohd Al Husseiny).

FINMA confirms that Coutts also was involved in the disappearance of a further $680 million dollars from 1MDB in March 2013. The sum matches the separate $681 million that was sent in the same period to Najib’s account in KL and went to Jho Low in two payments – did they halve the loot?

“Although Coutts had serious grounds for suspicion due to the unusual transactions from 2009 onwards, it opened a further business relationship with the Malaysian businessman in the summer of 2012. Contrary to the information provided when the account was opened, USD 380 million was transferred to this account from an offshore company in March 2013. A further USD 300 million followed. Pass-through transactions were then used to transfer most of the funds received to another domiciliary company belonging to the businessman. Despite the obviously suspicious nature of these transactions, the bank failed to look into them seriously and was content to make superficial enquiries.

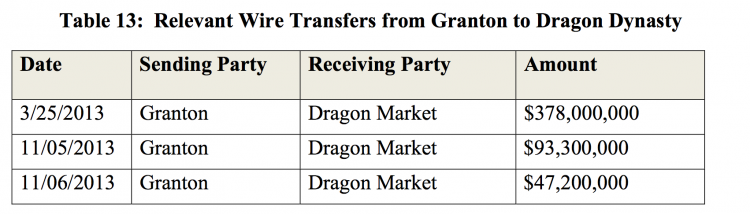

The separate DOJ filing from July has also traced these sum through Coutts, which went into the Coutts Zurich account of a Jho Low owned company called Dragon Market:

Much of the cash was then laundered back through another Jho Low account called Dragon Dynasty at BSI Singapore and into accounts owned by his father and brother, in order to disguise its criminal origin, according to the FBI.

FINMA makes clear its concern that the prime culpability for these transactions lay at the highest level at Coutts Bank. It means that very senior figures at Coutts in Zurich, as well as at BSI which went on to handle these transactions, were willing to participate in a culture of deliberate complacency when it came to processing huge sums of money from 1MDB:

A number of bank employees expressed serious, timely concerns to their managers and the Compliance unit about the business relationship with the Malaysian businessman. Following negative media reports, the individual responsible for providing advisory services to this businessman in Singapore noted: “I feel very uncomfortable with this guy and the transactions that are going through the account. I think the management has to make a decision whether to keep this relationship.” …… Instead it was decided to continue with the lucrative business relationships and process the transactions. As early as March 2012 the following was noted in an internal bank meeting about the business relationship with the Malaysian businessman: “[X] is a key client who we are comfortable with the Source of Funds, Source of Income and activity performed on these accounts”. In 2013 and 2014, various compliance bodies within the bank again raised and questioned the business relationship. On each occasion, however, they decided to continue with it.

Poor UK record on 1MDB

The owner of Coutts at that time was the UK government-owned entity RBS. FINMA says it has notified RBS and the UK financial regulator the Financial Conduct Authority (FCA). However, there is no evidence that any UK authorities have taken any action whatsoever to investigate any of the UK aspects of the 1MDB scandal. To the contrary, a British Foreign Office delegation in due in KL shortly to continue to lobby for preferential trade deals.

Last year the UK trade representative at a special reception held for Najib two days after London’s anti-corruption conference and in the same venue, Lord Marland, said it would not be right to judge a man (Najib) guilty until he was found to be so in court, implying that he is prepared to suspend judgement on several of the world’s most notorious criminals when it comes to trade and politics.

Switzerland on the other hand is taking action and today further indicated it is also looking at 5 more banks who were involved in the 1MDB scandal. BSI and Falcon are already facing proceedings – other names in the frame are Julius Baer, Credit Suisse, UBS and JP Morgan Suisse.

If any of these wish to appeal or plead innocence, then they will be able to bring the Malaysian Prime Minister, the sole shareholder and signatory of 1MDB, to testify on their behalf.