It was one of the first major mysteries to emerge after GE14 as the incoming PH government sought to grapple with the millions that had gone missing from 1MDB related enterprises in Malaysia.

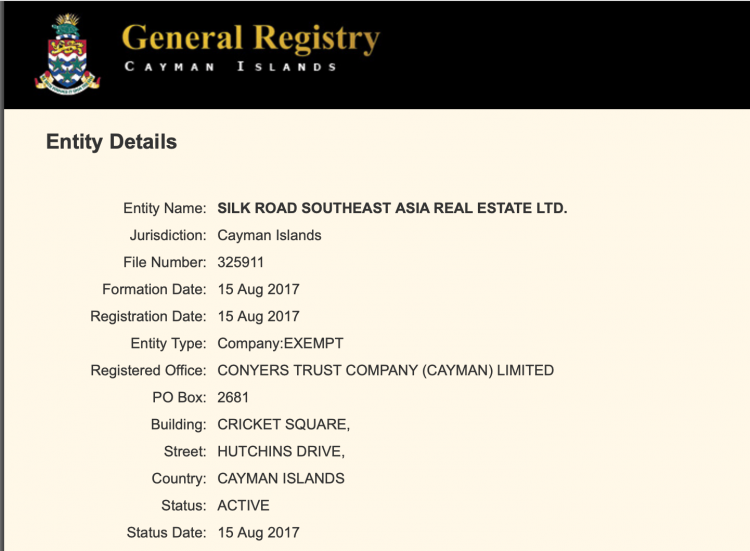

Land that had been acquired by the scandal ridden fund in Ayer Itam had apparently been sold on to an off-shore Cayman Island company with a name that suggested it was somehow related to the massive Chinese state Silk Road Finance Corporation which has sponsored infrastructure across the globe.

Reports emanating in July 2018 from Malaysia’s Finance Ministry, which was seeking to retrieve 1MDB’s stolen funds, established that Ayer Itam had been “surreptitiously sold”, despite a freeze by the state government at the time, to the Cayman Island company Silk Road Southeast Asia Real Estate Ltd for RM2.7 billion on Aug 24, 2017.

The first question was why would this company purchase the land and why through a secretive off-shore shell company?

Despite a freeze imposed by the Penang state government on transactions involving 1Malaysia Development Bhd’s (1MDB) Air Itam land in Penang, all 234 acres (94.7ha) have been surreptitiously sold to Cayman Islands-based Silk Road Southeast Asia Real Estate Ltd, according to Finance Minister Lim Guan Eng.

Guan Eng said the land was sold for 4.25 billion yuan (RM2.7 billion) on Aug 24, 2017, netting a profit of RM1.32 billion based on the original RM1.38 billion purchase price.

The sale was carried out through the disposal of the land’s owner, 1MDB unit My City Ventures Sdn Bhd, to Silk Road via a share sale agreement, Guan Eng said in a written parliamentary reply. [The Edge 30th July 2018]

However, there was a second even more surprising conundrum revealed by the new finance minister, Guan Eng in this parliamentary answer. He explained that this Silk Road entity had not even bothered to complete the deal, despite having paid such an astounding amount of money (double what 1MDB had itself paid and apparently several times more than the land was actually worth)

… the transfer of shares to Silk Road has yet to be completed.

“To date, SBSB [Ministry of Finance subsidiary] has yet to receive any application from Silk Road to have the shares transferred,” Guan Eng said in reply to a question on July 19 from Bukit Bendera member of parliament Wong Hon Wai on the status of the land. [The Edge 30th July 2018]

In other words Silk Road Southeast Asia Real Estate Ltd (Cayman Islands) had passed RM2.7 billion over to the Ministry of Finance for the 1MDB land without bothering to claim the title.

As The Edge reported, sources familiar with the issue said the transaction reeked of money laundering:

“Why do you throw so much money and don’t ask for the transfer of titles? The obvious answer is money laundering,” the source told The Edge Financial Daily.

Sarawak Report had already learnt in 2016 that the Ayer Itam asset formed part of Jho Low’s strategy for inflating Chinese investment contracts to float 1MDB (and his boss) out of trouble.

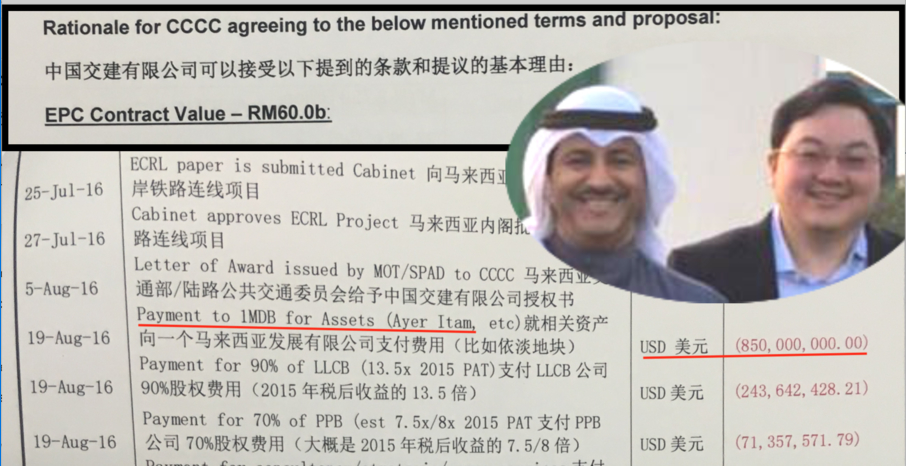

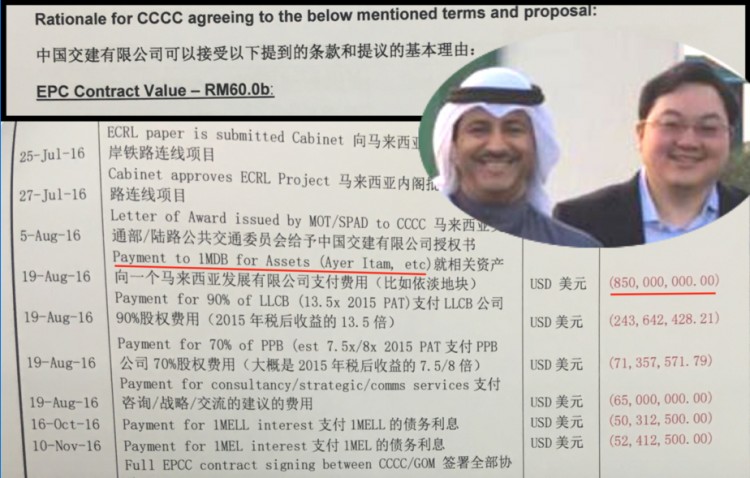

A secret document obtained in July 2016 revealed the hidden agreement between the Najib government and China state company CCCC that resulted in a 100% inflation of the East Coast Rail Line (ECRL) budget in return for a schedule of purchases of 1MDB and Jho Low assets plus payments of 1MDB’s outstanding debts.

The Ayer Itam land was listed near the top of that schedule to be bought by CCCC for a generous US$850 million (RM3.4 bn – more than double what 1MDB had originally paid for the asset) as early as August 5th 2016, just days after the Cabinet was expected to give its approval to the ECRL project on July 27th.

It is likely that by exploding the secret plans on the very day of the Cabinet meeting held to approve them Sarawak Report forced the conspirators, including the prime minister who ultimately ratified the ECRL deal in Beijing the following November, to adjust their plans.

Enter Sheikh (Stage Left)

As Sarawak Report has lately revealed Jho Low had been busy in the course of early 2016 making provision for the transfers of large sums of laundered money from these Chinese contracts using a new business relationship in Kuwait.

The by now fugitive Malaysian financier who, despite denials at the time was still working for Najib to resolve the growing crisis over 1MDB, had forged a business deal with the family of the then Kuwait prime minister and had agreed to pass the billions expected from these Chinese “commissions” through companies owned by Sheikh Sabah Jaber Al-Mubarak Al-Hamad Al-Sabah (Sheikh Sabah) the prime minister’s elder son.

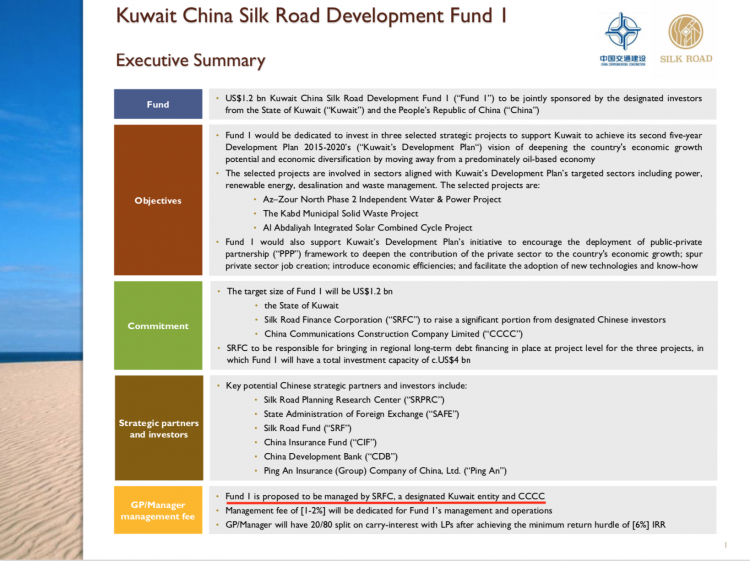

A ‘state to state’ investment initiative had been created, which provided the justification presented for these massive transfers of money, namely the Kuwait China Silk Road Development Fund, launched with the full public support of the prime minister and his family in Kuwait in April 2016 in the presence of the Chinese Ambassador and officials from China’s Silk Road Finance Corporation.

Even the nephew of the Chinese President, Mr. Xinyuan Liu, was flown over to attend the event and meet the Kuwaiti dignitaries from the prime minister’s family as plans were announced to invest $8bn in the scheme.

According to our source who was working with Sheikh Sabah, Mr. Xinyuan Liu was described to the Kuwaitis as a client of Jho Low, who was said to be providing him ‘business advice’.

As Sarawak Report has earlier detailed this purported Kuwait China initiative was subsequently used to explain to the ICBC bank in Kuwait why the Chinese state construction company CCCC (named as a partner in the Kuwait Silk Road development initiative) was starting to channel huge sums of money to one Komoros Gulf General Trading & Contracting Company owned by Sheikh Sabah and associates, on the grounds he was acting as the designated Kuwait entity managing the enterprise.

![This document sent by Jho Low in Sept 2016 was entitled "For ICIB [bank]"](/wp-content/uploads/imgcache/2020/05/pImg_5f5964fc65c6e338aee3f839c0c75939.png)

Joining The Dots?

With these facts in mind it becomes easier to divine who was really behind Silk Road Southeast Asia Real Estate Ltd (Cayman Islands) and the money sent for the ‘purchase’ of the land in Ayer Itam, not least because the finance minister’s answers back in July 2018 had also referred to an “Arab shareholder”.

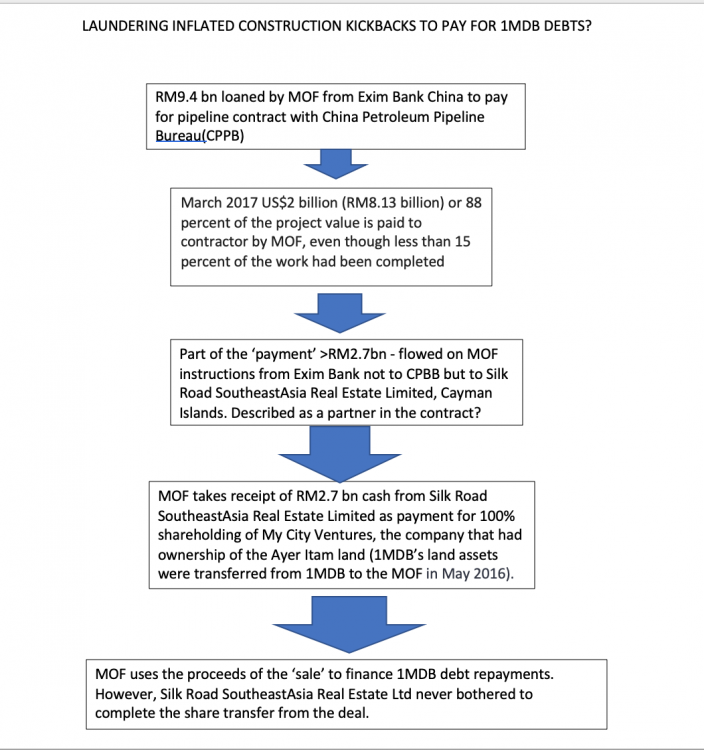

So what was Plan B for the Ayer Itam ‘sale’ to raise badly needed funds for 1MDB? The PH government had been surprised to discover a second massive contract entered into by Najib’s Ministry of Finance in early 2017 resulting in millions of dollars being suddenly paid out to a second Chinese state company purportedly to build two gas pipelines.

China’s Exim Bank had provided a loan to the Ministry of Finance owned Suria Strategic Energy Resources Sdn Bhd with which in March 2017 it paid the contractor China Petroleum Pipeline Bureau US$2 billion (RM8.13 billion) or 88 percent of the project value, even though less than 15 percent of the work had been completed.

The MOF company was later fined by a Malaysian Court for so negligently and inexplicably paying such a large proportion of the costs up front and both pipeline projects were then terminated.

On the surface there might seem little connection between the agreement between the Chinese state contractor CCCC’s earlier commitment to buy assets such as Ayer Itam at an inflated rate in return for a doubling of value of the ECRL project and these pipeline deals (although both projects were financed by Chinese state loans ultimately paid for by the Malaysian taxpayer). Indeed, China Petroleum Pipeline Bureau has denied it was involved in the purchase of Ayer Itam.

However, as early as the original reports in 2018 The Edge recorded the Ministry of Finance as suspecting that there was indeed a connection:

It is believed that the money [the RM2.7 billion paid for Ayer Itam] might have travelled from the ministry of finance’s (MoF) wholly-owned unit Suria Strategic Energy Resources Sdn Bhd’s RM9.4 billion gas pipeline project that was awarded to China Petroleum Pipeline Bureau on Nov 1, 2016. …

The money is suspected to have originated from the project’s financing via China Exim Bank before travelling to Silk Road, with an Arab shareholder, and returning to Malaysia where it was transacted in renminbi for the land, and later used to service the US$3.5 billion International Petroleum Investment Co (IPIC) loan. [The Edge 30th July 208]

Guan Eng did not identify the ‘Arab shareholder’, but rumour escaped that he was from the Kuwaiti Royal Family.

Owner Revealed

Sarawak Report has now established from reliable sources that the owner of the Cayman Island Silk Road Southeast Asia Real Estate Ltd was indeed Jho Low’s new associate from Kuwait, the son of the then prime minister, Sheikh Sabah.

The same Sheikh Sabah into whose Komoros Gulf and other accounts at ICBC bank in Kuwait the Chinese company CCCC had been pouring hundreds of millions of yuan since late 2016 in the name of the joint venture under the auspices of the Chinese Silk Road Finance Corporation – the arrangement set up and organised by Jho Low to launder commissions for Najib.

The use of bogus off-shore subsidiaries with deliberately misleading names is of course by now a well-known signature of Jho Low’s money laundering operations. The Cayman company clearly once again had nothing to do with the massive Chinese Silk Road Finance Corporation, which might well have transferred such a sum.

Rather, it would appear that once again it was Sheikh Sabah who had proved willing to lend his illustrious name and indeed connection to the Silk Road Corporation (thanks to the alleged partnership with Kuwait) to assist these transfers. The Cayman Island concern had nothing to do with the Chinese fund.

On the other hand, several Chinese state companies, banks, high profile businessmen and politically connected individuals now stand identified as having been up to their necks in various different ways in Jho Low’s thieving operations on behalf of his boss from the Malaysian public purse.

Perhaps this also explains another ongoing mystery in the 1MDB saga, which is why China has so far failed to return the fugitive financier back home, where he is wanted for questioning on high crimes in Malaysia?

Update:

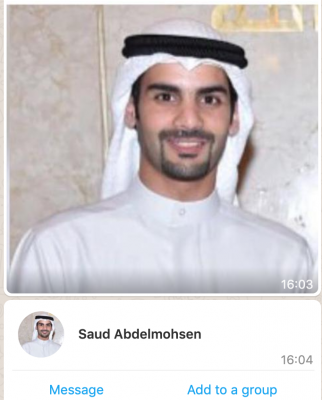

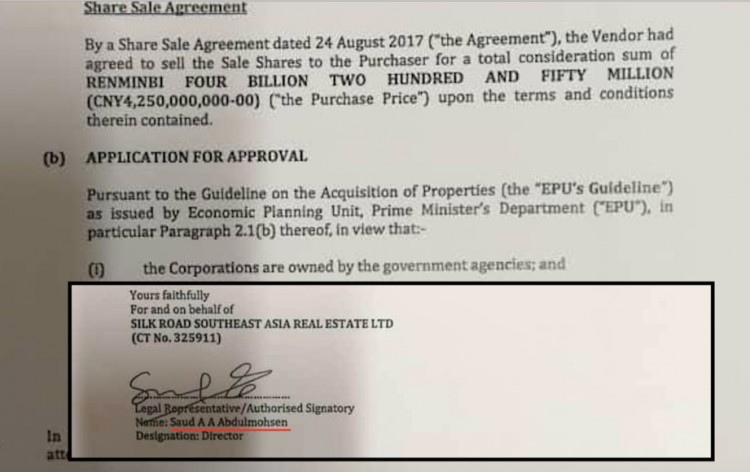

Documents now obtained by Sarawak Report show that the purchase for the Ayer Itam land was being handled and signed for by the Legal Representative of Silk Road Asia Real Estate Limited (Cayman Islands) named Saud Abdelmohsan.

Abdelmohsan has been confirmed by sources to be the lawyer who handled such matters of behalf of Sheikh Sabah.

Abdelmohsan has been confirmed by sources to be the lawyer who handled such matters of behalf of Sheikh Sabah.

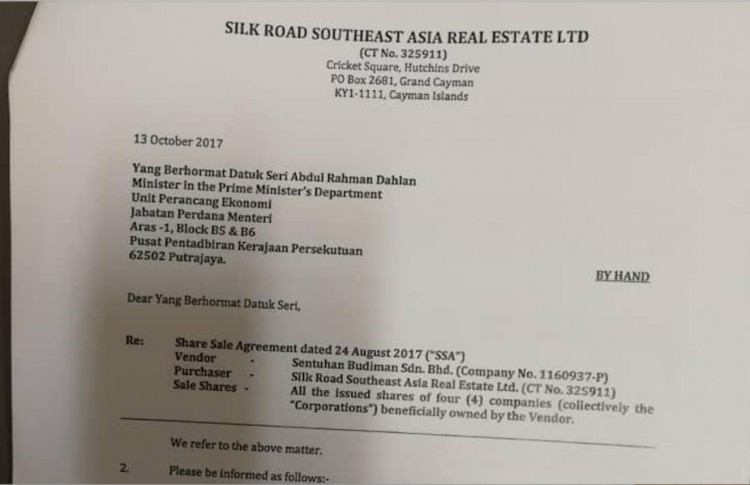

The company paid the Ministry of Finance subsidiary Sentuhan Budiman Sdn Bhd 4.25 billion yuan (RM2.7 billion) in August 2017, according to a letter addressed to Rahman Dahlan in the Prime Minister’s Office sent later in October.

At the time Dahlan was one of Najib’s most vocal and supportive newly-promoted minsters and the letter requested the hasty approval of the Economic Planning Unit for the purchase before a November 22nd deadline in order to regularise the transaction under Malaysian law. Otherwise they would demand the money back. The MOF had acquired the 1MDB land assets in May before the sale to China Silk Road Asia Real Estate Limited implicating it directly in the latter transaction.

After GE14, according to further information received from separate sources in Kuwait, the anti laundering money unit under the new PH government in Malaysia sent a request on 28th June 2018 to Kuwait for information about the Ayer Itam transactions.

The matter was transferred to the secret service on the grounds that ‘sensitive persons’ were implicated. Sarawak Report has learned that on 23 of October 2018 Sheikh Sabah himself, together with Jho Low’s friend and contact in Kuwait, Hamad al Wazzan*, were briefly interrogated on the matter for less than one hour.

Following this, the case was closed the following day on October 24th. On 29th October a report was sent to the then Minister of the Interior, Sheikh Khalid al-Jarrah al-Sabah, alleging that there was nothing suspicious to report.

Finally, on December 6th 2018 an answer was sent to the Malaysian inquiry to say that all was legal and properly documented with respect to the transaction.

*updated (June 1st 2021): Hamad al Wazzan has denied that he was acting as Jho Low’s proxy or agent in Kuwait.