It was announced last week that UK businessman Rick Haythornthwaite has been appointed to take over the 40% government owned Nat West Bank, as a ‘safe pair of hands’ following a recent furore over alleged discrimination against clients by its subsidiary Coutts.

This caused some surprise amongst followers of Malaysia’s 1MDB development fund scandal, which has been described as “the largest corruption case in the history of the justice department” and the world’s record theft, given Haythornthwaite’s unfortunate connection to key players involved.

I would be unwilling to assist you in your questionable activities

Back in December 2015 the IMDB scandal, originally exposed by this website, had been raging for nearly a year.

The Malaysian government had appointed a multi-agency Task Force to investigate what proved to have been a multi-billion dollar theft executed by the prime minister, Najib Razak, and his businessman proxy Jho Low.

Sarawak Report had already released a wide range of whistleblower material, including documents from the database of a so-called joint venture partner of 1MDB, the company PetroSaudi, that showed how the first $700 million stolen from the fund was siphoned into the Coutts bank account of Jho Low’s Seychelles company named Good Star Limited.

That PetroSaudi directors had collaborated in the theft was by then in little doubt. Jho Low had paid the owners Tarek Obaid and Saudi Prince Turki bin Abudullah over £80 million each for their part in the heist. Obaid in turn sent $35 million on to his key manager Patrick Mahony.

Both Obaid and Mahony are currently facing prosecution for fraud and money laundering in Switzerland, whilst Prince Turki has been incarcerated over corruption charges in Saudi Arabia since 2017.

Meanwhile, Jho Low has been on the run since Sarawak Report published its first articles on 1MDB in February 2015, Najib is now jailed and Coutts Zurich has been fined for facilitating money laundering by the Swiss regulator FINMA.

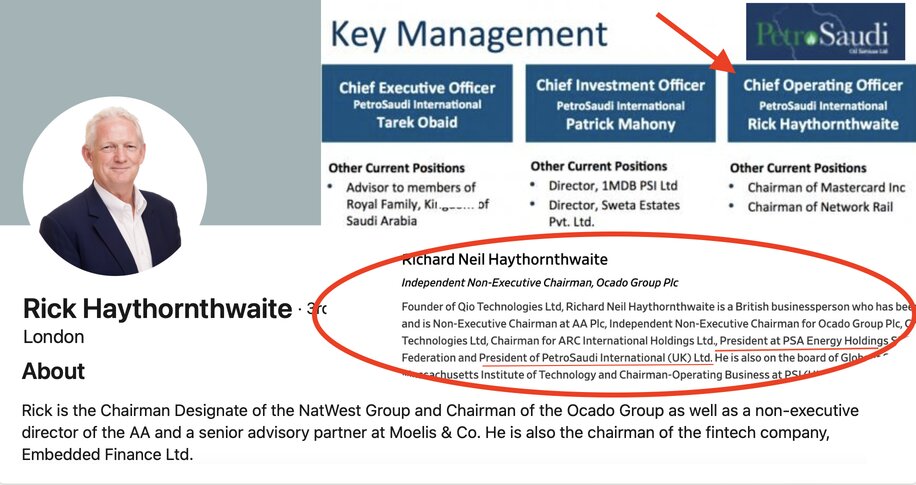

The other prominent figure associated with the relevant PetroSaudi International (UK) Limited at that time was its Chief Operating Officer and President, Rick Haythornwaite.

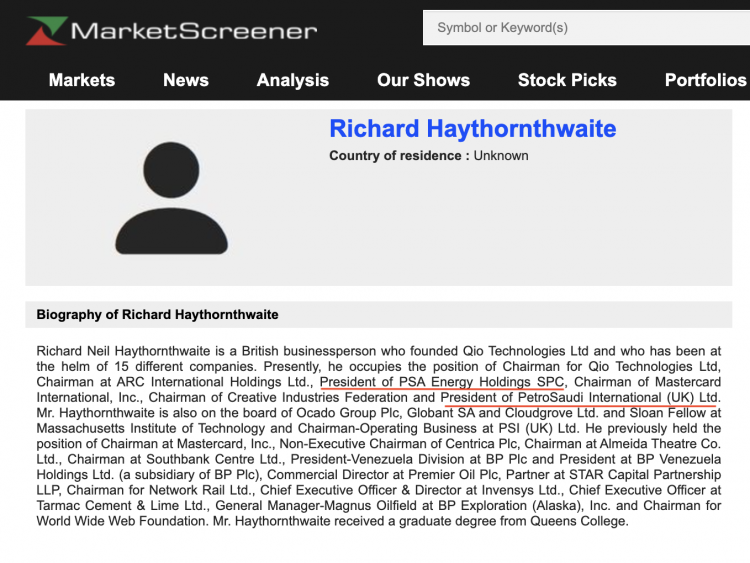

Haythornthwaite was already a well known UK businessman with a list of impressive connections, including his role as Chairman of Mastercard in the US. At the time he made no secret of his role as part of the “key management” of PetroSaudi, listing it in his various CVs available online.

Few such references remain and indeed his lengthy list of 35 past and current job titles on LinkedIn markedly fails to include his 8 year connection with PetroSaudi where he was regarded as their prestige appointment on a two and a half days a week contract.

Haythornthwaite’s continuing involvement with the company, even as further investigations by Sarawak Report in July 2015 revealed that no less than $681 million had been funnelled into Najib’s personal KL bank accounts – money believed by Task Force leaders to have come from 1MDB – was raising eyebrows in certain quarters.

The Wall Street Journal had taken up the story, endorsing SR’s revelations on Najib’s mysterious 1MDB bonanza. So it seems overly improbable that the businessman could have remained unaware of the extent of the controversy surrounding PetroSaudi’s ‘joint venture’ with the Malaysian fund.

By the end of the year Sarawak Report had gone on to publish dozens of articles pin-pointing the role that PetroSaudi played camouflaging the original theft and then camouflaging the use of more 1MDB millions to purchase Jho Low and Taib Mahmud’s interest in UBG bank by posing as the buyer.

As COO and President Haythornthwaite ought to have been on top of such major activities and aware of the accusations which the company naturally denied at the time, but which have all now been proven to be true.

Documents published by Sarawak Report have shown how Mahony and Jho Low conspired to limit and ‘control’ what information was made available to colleagues such as Haythornthwaite as the heist unfolded. However, even after the evidence was published Haythornthwaite remained in post.

Even more shocking, as far as Sarawak Report was concerned, was the imprisonment in Thailand of Haythornthwaite’s former close associate and PetroSaudi director, Xavier Justo, who had acted as the whistleblower in the case.

PetroSaudi’s directors, Patrick Mahony and Tarek Obaid, had conspired together with Najib, Jho Low and others to denounce their ex-colleague as part of their attempted cover-up of the thefts they were involved in.

A team of UK private security operatives, Swiss legal firms and PR companies were hired to frame Justo as a vindictive liar and accuse Sarawak Report of ‘doctoring’ Justo’s incriminating data.

Meanwhile, in Malaysia Najib had sacked a swathe of senior law enforcers who had sought to bring charges against him and then closed down all 1MDB investigations claiming falsely that no money had gone missing from the fund and that the hundreds of millions passed into his personal account were merely a ‘gift’ from Prince Turki’s father, the then King of Saudi Arabia.

On 6th December Sarawak Report finally wrote directly to Rick Hathornnthwaite to question him about an extraordinary new twist in the cover-up.

PetroSaudi’s Tarek Obaid had sent an official letter to 1MDB, that was immediately publicised in Malaysia, claiming that PetroSaudi was the owner of the company Good Star Limited that had received $700 million of the alleged $1 bn that was initially invested into the joint venture by 1MDB. (The payments to Good Star eventually totalled $1.5 bn).

Sarawak Report had already published compelling evidence that Jho Low, acting as Najib’s proxy, was the actual owner of Good Star, something that would be confirmed by the US Department of Justice investigation in a few months time. We therefore emailed Haythornthwaite to ask if he was prepared to support his company’s latest extraordinary claim?

“Dear Mr Haythornthwaite,

I am contacting you in your capacity as Chairman of PetroSaudi International and would be pleased if you could confirm whether or not you are aware of a letter sent formally by PSI to the Malaysian development fund 1MDB, with which it recently undertook a joint venture.

The letter confirms to 1MDB that PetroSaudi was the beneficial owner of the company called Good Star Limited, incorporated in the Seychelles, which received payments of just under US$1.5 billion dollars from 1MDB during and after the course of that joint venture arrangement.

I would be grateful if you could tell me whether you personally authorised the sending of such a letter are are prepared to stand by the claim that PetroSaudi was the beneficial owner of Good Star at the time of those transfers?

Seemingly untroubled by the seriousness of the mass of allegations against the business he was entrenched in, Haythornthwaite replied:

Dear Ms Rewcastle,

Having now done some research into your background, it is clear that you are an active campaigning blogger rather than an objective journalist with a desire to understand the true facts behind this matter. That your email to me contains fundamental factual errors – not least suggesting that I am, or have ever been, chairman of PetroSaudi International [he was President] – reinforces my concerns about your credibility.

Therefore, even if I were to be in possession of information relevant to your query, I would be unwilling to assist you in your questionable activities”.

Sarawak Report responded that given this matter was by now an international story Mr Haythornthwaite might very soon find himself required to answer other journalists as well whom he might find less easy to dismiss and disparage – ie from major news organisations.

Sunday Observer

The day of reckoning in fact did not arrive until the announcement of his new high profile appointment to rescue the reputation of a beleaguered bank whose CEO has been forced to resign. He will take over as Chairman in April.

By that time Haythornthwaite’s pukka profile was largely cleansed of the association with PetorSaudi which he had left, at long last, following the devastating indictment by the US Department of Justice in July 2016 in which PetroSaudi, Jho Low and Good Star were clearly named and identified as components of the plot to steal $5 billion from the Malaysian public purse.

Somehow, the due diligence by Nat West had failed to pick up on the awkward connection (or perhaps they didn’t care), which has the further disadvantage of linking him to unethical behaviour on the part of a bank he is about to take charge of, namely Coutts.

However, according to a series of exposes this Sunday, the Observer newspaper challenged the Chairman designate last week to explain his dismissive behaviour towards Sarawak Report, in the light of the multiple Red Flags that by then existed against PetroSaudi and its dealings with 1MDB.

Haythornthwaite apologised on the grounds he had been misinformed despite his privileged position to obtain the truth about his own company’s structure and operations (the Observer has learnt he has been approached as a potential witness in the Swiss case against the directors of the company). According to the Observer:

It is understood Haythornthwaite now wishes he had offered a more considered response to a credible warning over what turned out to be a global money laundering conspiracy involving Malaysian financier Jho Low, Malaysia’s prime minister and companies including PetroSaudi.

In July 2016, the US Department of Justice described the 1MDB scandal as the largest kleptocracy case it had ever handled. Sources close to Haythornthwaite say he believes Rewcastle Brown deserves credit for what she uncovered. [The Observer 10th September 2023]

In a related article the paper provides an explanation given by Hathornthwaite for his stonewalling of Sarawak Report. It writes “A source close to Haythornthwaite said there was conflicting information about the authenticity of some leaked emails, with claims that some had been doctored. Now, however, the City stalwart recognises he could have responded more helpfully”.

Nevertheless, Haythornthwaite’s confessions to The Observer’s further digging on the topic have perhaps inevitably raised more questions than answers for concerned City and Parliamentary observers.

The paper has obtained further material relating to the mandarin’s relationship with PetroSaudi that he would plainly have preferred expunged. This relates in particular to an employment contract issued by PetroSaudi International (UK) Ltd, starting in October 2010 yet expressly backdated to cover the period from his initial engagement as a COO from 2008.

Sarawak Report has also seen the document which, as the Observer notes:

says his “basic salary will be £200,000 a year” and stipulates a working week of at least two and a half days. It also says he will, subject to various provisions, be enti- tled to bonuses of £1m by 28 February 2011 and £1m within two months of 1 June 2014.

However, the paper says that Haythornthwaite has denied these terms were ever put in place. Specifically, he denies he was granted a £2 million bonus by the company. The explanation given to the paper by ‘sources close to him‘ on his behalf is that “various versions of contracts were drawn up between him and PetroSaudi, and that he did not receive the £2m in bonuses”.

The paper adds that “Haythornthwaite did not respond to questions over what bonuses, if any, he was paid and whether he established the source of such funds”.

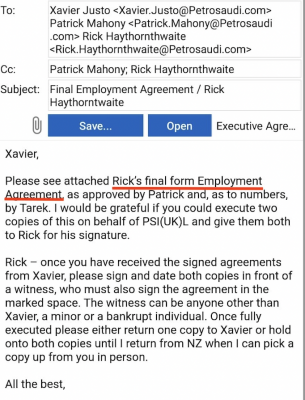

Sarawak Report finds this explanation strange, given the copy of the above described contract was attached to an email sent by PetroSaudi’s company lawyer to its then manager Xavier Justo and copied to Haythornthwaite himself and the two directors now facing prosecution, Patrick Mahony and Tarek Obaid.

This is what that email, entitled “Final Employment Agreement / Rick Haythornthwaite” starting 1st August 2010 says:

Xavier,

Please see attached Rick’s final form Employment Agreement, as approved by Patrick and, as to numbers, by Tarek. I would be grateful if you could execute two

copies of this on behalf of PSI(UK)L and give them both to Rick for his signature.

Rick – once you have received the signed agreements from Xavier, please sign and date both copies in front of a witness, who must also sign the agreement in the

marked space. The witness can be anyone other than Xavier, a minor or a bankrupt individual. Once fully executed please either return one copy to Xavier or hold

onto both copies until I return from N when I can pick a copy up from you in person.

This would strongly imply that this was the final of those various drafts referred to by Mr Haythornthwaite and that, negotiations having been completed, only signatures remained to be attached.

Is it not therefore incumbent on the new Nat West Chairman to explain under what circumstances this might suddenly have all been altered and to present the actual contract which he claimed failed to include such terms or bonus?

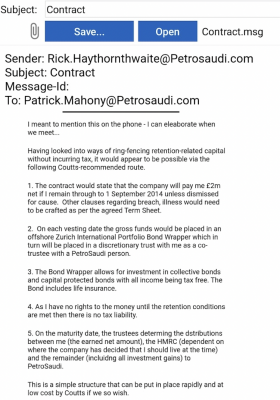

There is another conflicting matter, which is that SR has also sighted a related email, this time written by Mr Haythornthwaite not long after, on 3rd October 2010, to Patrick Mahony, also entitled “Contract”.

In this email Haythornthwaite appears to discuss a proposal to avoid tax on that same £2 million bonus through a series of “simple” manoeuvres recommended by none other than Coutts Zurich.

The proposal involving off-shore discretionary trusts of which Haythornthwaite would act as a trustee, appears to involve PetroSaudi deciding on a foreign place to choose for Haythornthwaite to be residing for purposes of tax at the time the scheme matured.

Yet according to the contract at the time the company COO/President resided in London SW1 and the employer PetroSaudi International (UK) Ltd was a UK registered company.

I meant to mention this on the phone – I can elaborate when we meet…

Having looked into ways of ring-fencing retention-related capital without incurring tax, it would appear to be possible via the following Coutts-recommended route.

1. The contract would state that the company will pay me £2m net if I remain through to 1 September 2014 unless dismissed for cause. Other clauses regarding breach, illness would need to be crafted as per the agreed Term Sheet.

2. On each vesting date the gross funds would be placed in an offshore Zurich International Portfolio Bond Wrapper which in turn will be placed in a discretionary trust with me as a co-trustee with a PetroSaudi person.

3. The Bond Wrapper allows for investment in collective bonds and capital protected bonds with all income being tax free. The Bond includes life insurance.

4. As I have no rights to the money until the retention conditions are met then there is no tax liability.

5. On the maturity date, the trustees determing the dstributions between me (the earned net amount), the HMRC (dependent on where the company has decided that I should live at the time) and the remainder (including all investment gains) to

PetroSaudi.

This is a simple structure that can be put in place rapidly and at

low cost by Coutts if we so wish.

The source close to Mr Haythornthwaite has reportedly told the Observer that this arrangement would have indeed “not have been considered appropriate”.

The paper says the source also says “the proposal was never executed” and that “the source also said Haythornthwaite could not recollect ever writing such a document”.

Given Sarawak Report has seen the document and it is attributed to his email address from the very same reliable source that all the now validated material on PetroSaudi was obtained, perhaps Mr Haythornthwaite should be questioned further on this matter from his prospective future employers?

It is surely troubling that the proposed future Chairman of the UK’s flagship, part publicly-owned bank, may have even floated the possibility of an off-shore tax avoidance vehicle relating to a British contract that he now dismisses as not appropriate?

Is it not equally concerning that the bank which was apparently offering this facility is none other than the scandal hit institution that this Chairman has been appointed to bring back in line?

It is a situation made even more complicated by the fact that the very Coutts was so deeply embroiled and found guilty of misconduct in the world’s largest financial scandal in which Nick Hathornthwaite was also indirectly embroiled – and took far longer than some would consider he ought to have done to disentangle from.

According to the focus of the company and information received, the majority of Mr Hathornthwaite’s activities for PetroSaudi were focused on operations in Venezuela. This was where the majority of the cash received from 1MDB was invested in lucrative drilling contracts that Venezuelan prosecutors now complain were corruptly acquired through backhanders to officials.

See Sarawak Report’s exclusive expose on PetroSaudi’s Venezuela fiascos.

There is no evidence that Rick Haythornthwaite, a long-term specialist in Venezuela as a former representative of BP, was involved in framing those corrupt contracts. Last year the company’s profits from Venezuela (totalling £340 million) were finally seized by the US Department of Justice after a lengthy legal battle on the grounds the assets should be rightfully returned to Malaysia’s still heavily indebted 1MDB.

Nevertheless, questions over judgement and moral character are surely begging to be asked and many will be wondering why these issues were not identified and those questions asked a great deal sooner, given the information that has been available on this website and elsewhere for very many years.

Sarawak Report has not directly contacted Mr Haythornthwaite, given his previous reply and earlier responses to the Observer. However, he is welcome to contact our email if he has comments on our comments – [email protected].